Accounts & Settlements With

How It Works

Step 1

Apply on Mulya

Submit your documents on Mulya and get virtual bank accounts in USD and more.

Step 2

Client Pays

Client pays via local bank transfer to the respective virtual account.

Step 3

Foreign Currency Received

Hold foreign currency in the virtual accounts. Withdraw only when you want to.

$500 received from Amy James.

15 Sep, 04:20 PMOn time

Withdrawal request placed for $500. Converted to INR.

15 Sep, 04:25 PMOn time

Step 4

e-FIRS Issued on

17 Sep, 11:00 AM

This keeps you compliant with all Indian regulations, including GST.

Secure. Compliant. Reliable.

We are backed by the Govt. of India

Your data is encrypted by 256-bit military grade encryption.

Secure Payments. Fully compliant with FEMA regulations.

Accounts with trusted banks.

Morning, or night, our support team's logged on.

Now Use Mulya Accounts For Withdrawals

Save upto 70% when you use Mulya accounts for withdrawals from these platforms.

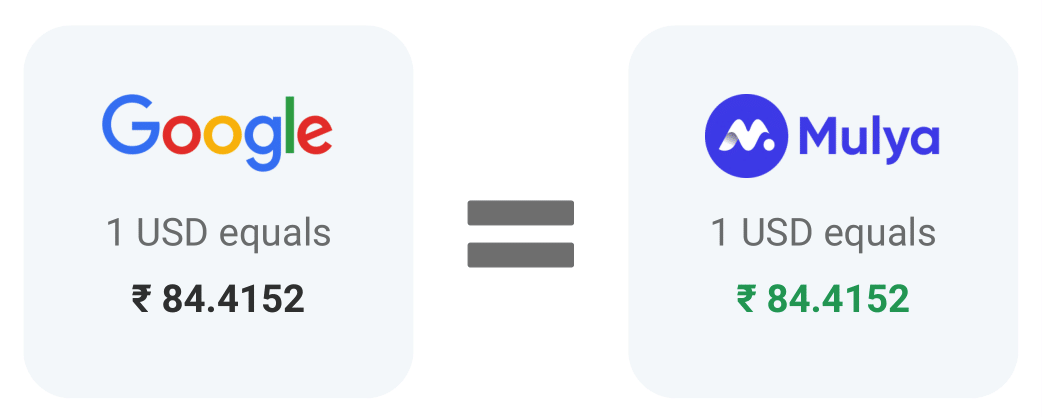

Get the rate you see on Google.

Zero Forex Markup. See how much you will get even before conversion.

Free e-FIRS Within 24 Hours

Stay compliant with the Indian GST and tax regulations. Issued by banks like Yes Bank.

Reviews

100% Transparent Pricing

Invoice Amount (USD)

- ₹ 0.00 (1%)

All-inclusive! ZERO additional GST. ZERO hidden charges.

You'll Receive in Bank

₹ 0.00